HealthGrade: An Indicator for Health and Wealth

KEY INFORMATION

Infocomm - Big Data, Data Analytics, Data Mining & Data Visualisation

TECHNOLOGY OVERVIEW

Insurers are increasingly shifting from traditional static underwriting to data-driven models that leverage health data and medical records. With advances in digital health infrastructure and wider availability of electronic medical records, insurers can now assess risk more accurately and personalize premiums.

Beyond pricing, insurers are also using health data to incentivize preventive behaviors, rewarding policyholders who maintain healthier lifestyles with reduced premiums or benefits. This convergence of healthcare and insurance reflects a broader move towards proactive, personalized, and engagement-driven insurance models.

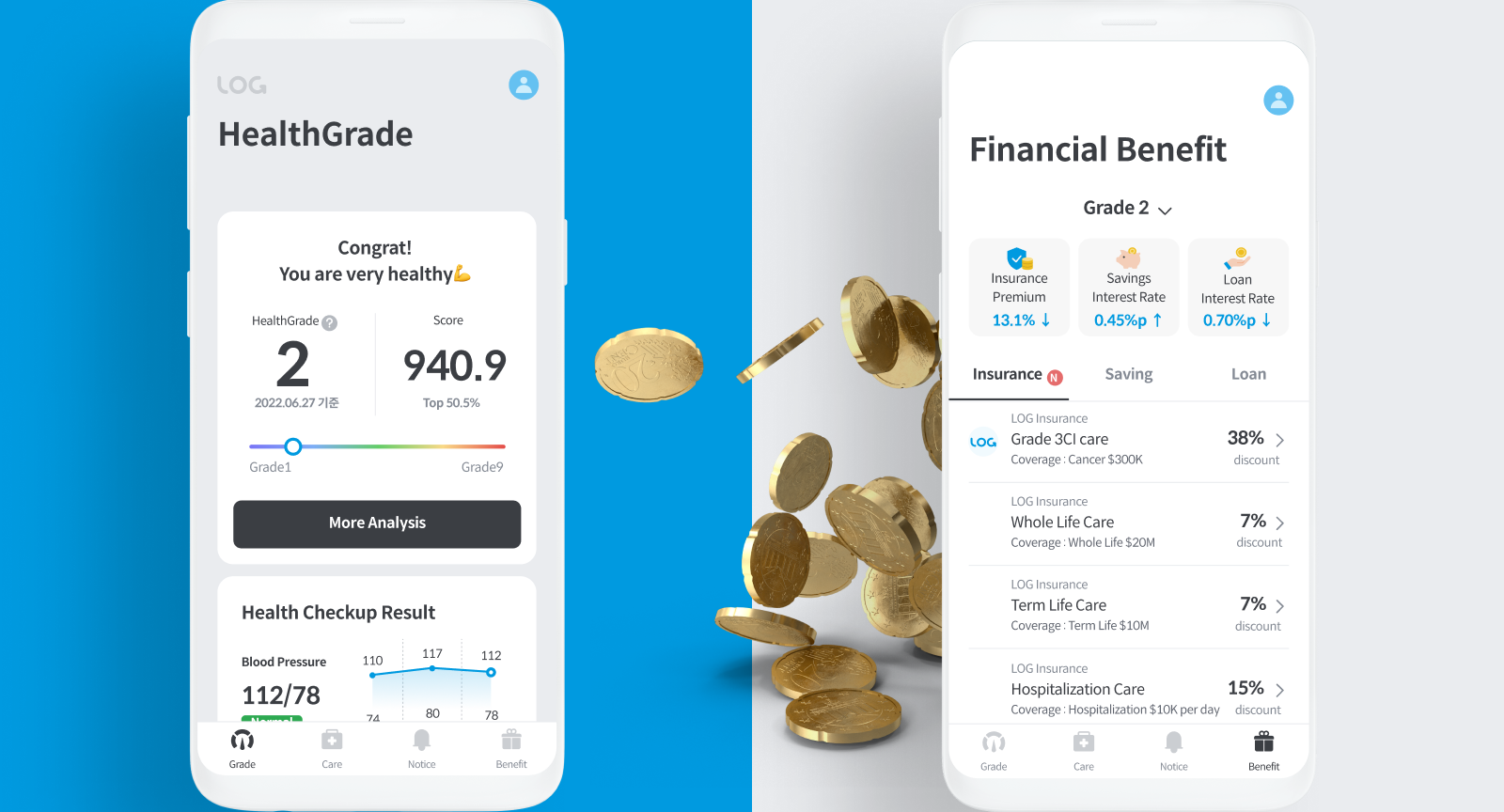

This technology known as HealthGrade quantifies individuals health status based on digital health data such as health check-ups and medical usage history. By using it like a credit score in the credit market, HealthGrade aims to innovate insurance pricing and underwriting. It personalizes underwriting decisions beyond static rule-based methods. HealthGrade is currently used by insurers and helps develop health-promoting products offering financial rewards for healthier behaviors. This creates mutual value for insurers and consumers.

The technology owner is seeking to partner with:

- Insurance and Reinsurance companies

- Healthcare companies looking to leverage big data

- Government association for public health

- Regulatory sandbox entities in Asia

TECHNOLOGY FEATURES & SPECIFICATIONS

Health Data Aggregation & Modeling: HealthGrade is based on a statistical model that objectively analyses an individual’s health status using health big data (checkup results, medical usage records, prescriptions etc.) from over one million people.

HealthGrade Indicator: Proprietary scoring system that works like a “FICO score for health".

Dynamic Pricing Engine: It encompasses both actuarial techniques that link health data analysis to insurance products and the software algorithms that implement these models. It calculates relative disease risks and translate them into risk rates and insurance premiums.

Automated Underwriting (UW): One-stop underwriting process via digital health data conversion, customized premium proposal giving relative ratio for coverage, allowing issue of policies in <5 minutes.

Building customized service: Increased touchpoints with customers and financial rewards on improvement of grade.

POTENTIAL APPLICATIONS

This technology can be applied to both the insurance and healthcare industries. It presents an individual’s current health status, provides guidance on health improvement, and enables the design of innovative health improvement–linked insurance solutions in which premiums are reduced as health improves. At the same time, it delivers strong motivation, offering a complete healthcare service.

The market potential for dynamic pricing in insurance is significant, as it addresses both insurer profitability and consumer demand for fairness. Globally, rising digital health adoption, proliferation of wearables, and regulatory support for personalized financial services are accelerating this shift. Analysts project that dynamic, data-driven insurance models could capture a substantial share of the life and health insurance market over the next decade, particularly in regions with strong health data ecosystems like Asia and Europe, positioning it as a major growth frontier for insurers and insurtechs alike.

Unique Value Proposition

The greatest value of the technology comes from real-world experience in productizing health assessment indicators into insurance solutions. Beyond simply serving as a measure of health, these indicators function as financial-linked metrics that directly impact insurance pricing. This is the key differentiator, and the technology is currently delivering innovation to 20 insurers in Korea.

HealthGrade stands apart through its actuarial foundation and quantified relative risk model. Competing models typically only collect activity data or assess health age, without impacting insurance pricing structures. In contrast, HealthGrade calculates risk rates that directly influence core premium pricing. It enables insurers to segment customers within similar risk groups and applies precise risk-based pricing.

The solution aligns with the core functions of Insurance: Risk evaluation and Pricing.